EXECUTIVE SUMMARY

The fluctuating global economy and changing climate will present insurance challenges in 2025

Rising climate risks, economic trends and shifting consumer behaviors are reshaping insurance coverage needs and underwriting strategies. Increased capacity is pushing down rates, affecting renewals and new business, making true growth a challenge.

Underwriters are becoming more selective in the risks they write, particularly in catastrophe-prone areas, and limiting policy concentration in high-risk areas to mitigate potential losses. With today’s fluctuating insurance landscape, agents and brokers must work harder to stay ahead of industry trends to best serve clients and ensure they’re adequately protected for any event that comes their way.

losses. With today’s fluctuating insurance landscape, agents and brokers must work harder to stay ahead of industry trends to best serve clients and ensure they’re adequately protected for any event that comes their way.

Demand for private flood and specialty property insurance continues to expand, with economic and real estate trends — including rising construction costs and shifts in homeownership— creating greater levels of exposure, and leaving many property owners underinsured. Agents and brokers will continue to play a key role in educating clients about their risks and the comprehensive coverage available.

And with the increasing frequency and severity of catastrophic weather events, including wildfires and convective storms, it’s imperative that brokers and agents partner with carriers who can navigate this evolving landscape and write the coverage their clients need.

The same CATs impacting the property market also are increasing underwriting scrutiny for fine art and collectibles insurance. Brokers will need to help clients manage their risk and understand the benefits of specialized coverage to protect valuable assets.

Learn how Tokio Marine Highland can help you better educate clients on flood, property and fine arts risks, and ensure they have adequate coverage to remain resilient long into the future.

Climate Risks and Claim Values Key Challenges in 2025

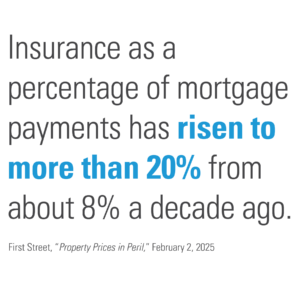

The private flood insurance market is expanding as extreme weather events increase flood risks. Rising construction costs, inflation and real estate trends contribute to heightened exposure, while shifting climate patterns and inadequate flood maps leave many unaware of their true risk.

Underwriters are leveraging advanced data tools and analytics to refine risk assessments, making flood coverage more accurate and accessible. However, to protect their clients in this fluctuating environment, agents and brokers should be focused on long-term resilience, looking beyond price to guide clients to comprehensive coverage from a financially stable carrier with a track record of extensive claims support and excellent customer service.

CAT Events Will Remain a Market Disrupter This Year

Increasingly severe weather events, from wildfires to convective storms, are reshaping specialty property insurance. With insurers pulling back from high-risk areas, many property owners are forced into last-resort options like lender-placed insurance. The unpredictability of carrier participation complicates underwriting, and social inflation is further driving up policy costs.

Brokers and agents can best help their clients navigate these challenges by emphasizing risk prevention measures, staying informed about carrier participation and working with experts to secure appropriate coverage. Taking time to find the right insurer, rather than focusing solely on cost, ensures long-term protection and policy sustainability.

Fine Art Market Remains Steady

Despite Changes

Despite broader market volatility, fine art and collectibles insurance remains stable. However, underwriters are tightening requirements in catastrophe-prone areas, closely scrutinizing location risks, structural resilience and storage practices. Policyholders in high-risk regions may face exclusions, higher deductibles or rate increases.

These trends have led more high-net-worth individuals to self-insure their art and collectibles, which could potentially leave clients without the expert support services they need to conserve or restore pieces damaged by an event. Agents and brokers need to be able to educate clients on risk mitigation and offer an array of flexible fine art insurance options to meet their needs.