Spring is here, and for many areas of the country, that means increased risk of flooding from the threat of heavy rainfall. According to data from the National Oceanic and Atmospheric Administration (NOAA), five of the six costliest floods since 1980 were spring floods or the result of heavy spring precipitation that led to conditions that set the stage for severe flooding events during the summer months.

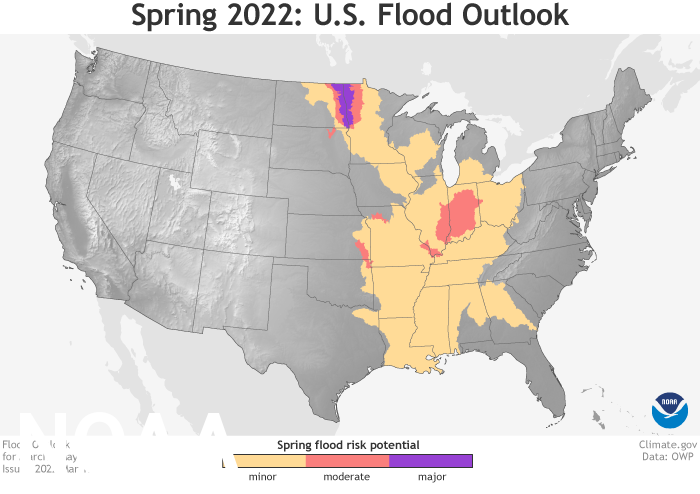

While forecasters from the National Oceanic and Atmospheric Administration (NOAA) are not predicting the severe, widespread flooding experienced during the 2019 spring season, several areas of the country are still at an above-average risk of flooding, including the Great Lakes and Ohio River Valley regions. Researchers are anticipating less severe flood risk for the eastern half of the continental U.S. this spring, but also anticipating yet another above-average Atlantic hurricane season that warrants risk assessment and insurance considerations sooner than later.

Are Your Customers Protected?

When working with your customers, it is important to consider the following:

- One out of every four of your customers will likely experience a flood event. In areas of moderate- to high-risk, there is a 26 percent chance of experiencing a flood over the term of a 30-year mortgage.

- More than 20 percent of flood insurance claims occur in moderate- to low-risk zones where coverage is not lender-required, according to the Federal Emergency Management Agency (FEMA).

- Flood damage is the nation’s most common and costliest natural disaster, yet less than 20 percent of homeowners are protected.

- Only one inch of water in a building can cost tens of thousands of dollars in damage. Even minimal flood insurance coverage can protect your clients from directly incurring the cost of such a devastating loss.

Wider Range of Options, Better Coverages with Private Flood Insurance

There has never been a better time to talk with your customers about the risk of flooding and that private flood insurance solutions offer higher limits, broader coverages and more stable and competitive rates than what is available from the National Flood Insurance Program (NFIP).

For more than 25 years, Tokio Marine Highland has been a trusted source for private flood insurance, so you can be confident in our knowledge, underwriting expertise and longevity when presenting your customers with our innovative flood solutions. To learn more about Tokio Marine Highland’s comprehensive flood offerings or to have us quote your potential target risks visit our Private Flood Insurance page or contact us at PrivateFloodSolution@tmhighland.com.